“In the end, I’m speaking toward the only outcome feasible for old Valiant-for-Truth in Pilgrim’s Progress: My sword I leave to him who can wield it.”

-Charlie Munger (Rest in peace. Throughout this write- up, Charlie and many of his friends will be referenced).

Summary: Coca-Cola’s top-tier, battle-hardened growth bottler is trading as if it were a declining, unbranded franchise.

What’s causing the mispricing: a word on investing in Turkey

“A pack of lemmings looks like a group of rugged individualists compared with Wall Street when it gets a concept in its teeth” -Warren Buffett

The core of this thesis is that, like a pack of lemmings, institutional investors are playing follow-the-leader in a race out of equities that trade in Turkey, citing runaway inflation and political uncertainty. This institutional exodus has caused mispricing of a handful of pristine companies: “Munger-esque [quality, growing] businesses at Grahamian [dirt-cheap] prices” as Mohnish Pabrai has described it.

It is almost an entirely good idea to not invest in Turkish equities during rampant inflationary periods. But as Charlie taught, it’s not our bad ideas that we have to worry about - it’s our good ideas that are taken too far. Perhaps 99% of companies on the Istanbul stock exchange are justifiably unattractive for investors. But many investors are lumping the last 1% in the same pile as the first 99%.

Charlie taught to “fish where the fish are.” He also taught to “invert, always invert” when approaching a problem. Mohnish Pabrai has taken these two injunctions and combined them into a lesson of his own: fish where the fish are, and where the fishermen aren’t. Pabrai’s new fishlosophy has led to a stocking stuffed with 50% Turkish equities and 25% coal, and it is trouncing just about all others in succeeding unconventionally.

“...it is better for reputation to fail conventionally than to succeed unconventionally”

-John Maynard Keynes, The General Theory of Money and Credit

On Wall Street, Turkish equities are an investment in which losses would constitute “failing unconventionally.” For professionals in the business of building a long, steady career on Wall Street, the risk-reward calculus doesn’t pencil out: succeeding unconventionally does offer some upside, but failing unconventionally offers huge downside (having no career at all). After all, even an ape can enter Wall Street and fail unconventionally. Failing conventionally requires far more sophistication. So, heads you get a small raise, tails you’re dead. Do you take the chance?

Most people on Wall Street are astute investors - in their own careers. Skipping the entirety of Turkey by putting it in the “too risky for my career” pile is the rational choice in terms of probabilistic career payouts. This (slightly exaggerated) incentive structure ensures crowd-like behavior towards that which is in vogue and away from that which is out of fashion. It’s also what’s causing one of Coca-Cola’s best growth bottlers to trade at bargain prices.

Coca-Cola’s Bottling Strategy: “The Coca-Cola System”

First, a word on Coca-Cola’s business model. Coca-Cola owns about 200 separate brands, 26 of which are individually worth at least $1B. Coca-Cola sells the right to operate select brands in select territories to independent “bottlers.” These rights are granted to over 200 such bottlers globally, who carry out the Coca-Cola operations in virtually every country in the world. Coca-Cola tends to also be a minority shareholder of their bottling partners - 20% in CCI’s case. This creates a symbiotic relationship whereby Coca-Cola benefits both from increased sales of their product and the financial success of their bottling companies, and vice versa.

Coca-Cola spends big on advertising to create demand for its products, and sells syrup-concentrate to bottlers as the bottlers focus their efforts on adding water and sugar, bottling the finished product, and placing the beverages attractively within arm’s reach of consumers. This system is part of Coca-Cola’s capital-light business model - the goal is for Coca-Cola to be more like a “soft drink software” company. Coca-Cola has very high margins and is able to grow with minimal incremental capital.

“The iron rule of nature is that you get what you incentive for” -Charlie Munger

This bottling strategy has caused considerable incentive misalignments between Coca-Cola and its bottlers in the past. The trick is to get territory into the hands of highly competent, highly motivated bottlers, and out of the hands of complacent or incompetent bottlers. In fact, Coca-Cola is in a decade-long process of loading underperforming territories back onto its balance sheet, improving them via its expert in-house “Bottling Investments Group” (BIG), then re-franchising the territories back to highly competent, highly motivated bottlers with refreshed, incentive-aligned bottling agreements. More on the Bottling Investment Group later.

How Coca-Cola Içecek fits into “the Coca-Cola System”

One such independent bottler is Coca-Cola Içecek (CCI). Of the 200+ bottlers in the Coca-Cola network, CCI is the 6th-largest by sales volume, and the 4th-largest by population. Although it is headquartered in Istanbul and trades on the Istanbul exchange, more than 60% of its sales are outside of Turkey.

Source: CCI Investor Presentation

To Coca-Cola, a company whose future growth is expected to come mostly outside of the US, CCI is one of the flagship emerging markets growth bottlers. CCI’s territories have particularly low per-capita consumption and tend to be economically volatile. They therefore require some intelligent maneuvering to unlock growth, and are an area of interest for Coca-Cola.

Dollar-based growth amidst foreign currency headwinds

“Under harsh environments, obviously some businesses will thrive. We want to find those businesses, and buy when the price is right.” -Li Lu

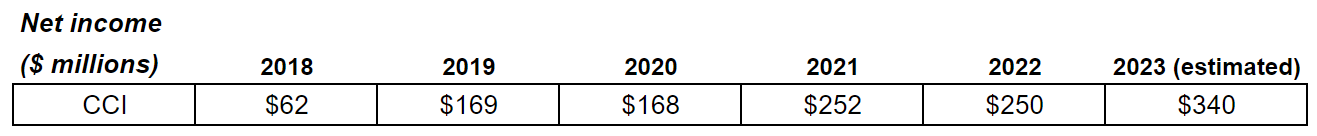

By leveraging the power of the Coca-Cola brands, CCI is proving remarkably resilient through macro-volatility, steadily increasing prices in dollar terms and posting a 40% annual growth rate in dollar-earnings over the past 5 years, despite its markets’ inflation troubles:

CCI currently has two primary markets: Turkey and Pakistan, together constituting about 55% of sales. In 2023, both of these markets posted some decades-long “bad for business” records, causing lollapalooza-effect macroeconomic headwinds for CCI:

Turkey: a 7.8 earthquake, election year, 50+ percent inflation

Pakistan: increase in excise tax on soft drinks, highest inflation in decades, lowest consumer confidence level in decades, low consumer purchasing power

Because of this, 2023 was a year during which CCI investors braced themselves. It remained to be seen with what force CCI could navigate against these headwinds.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business.” -Warren Buffett

“The cemetery for seers has a huge section set aside for macro forecasters” -Warren Buffett, essay on Foreign Currencies and Equities. (Or, to invert, the investing hall of fame is full of those that did not overly weigh macroeconomic forecasts).

How well did CCI navigate against the macroeconomic headwinds? In 2023, despite these headwinds, CCI increased its price per unit case from $2.00 to $2.50, while gaining market share over competitors. The result so far has been both record earnings and record returns on capital that just might stick in the years ahead. Although Pakistan volume was down 19% year over year, CCI gained an above-historical-average 2.4% market share in 2023. CCI is as impervious to negative macroeconomic environments as an investor can reasonably expect.

Bottling-ception and homerun territory acquisitions will lead to sustainably high returns on capital

"Over the long term, it is hard for a stock to earn a much better return than the business which underlies it earns…If a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive-looking price, you'll end up with a good result." -Charlie Munger

Average LTM return on capital for 4 other large Coca-Cola bottlers is 14.1%. CCI’s is approaching 20%. What could possibly be the secret formula for this success?

“I would like to close today’s webcast by sharing the success formula of CCI” explained Karim Yahi, in his first earnings call as CEO of CCI. Turns out at least one Coca-Cola formula isn’t so secret after all. “...we work with independent 3rd party distributors, who are exclusive to CCI in the NARTD industry and who carry most of the capex...we build their capability, train their sales staff and download CCI’s way of serving.” By off-balance sheeting some distribution assets, CCI requires less capital while still maintaining its in-house operational excellence. In a very real sense, CCI is copying the Coca-Cola Atlanta bottling playbook. (Requiring low incremental tangible capital needs is particularly important in high-inflation times, as Buffett taught in his 1983 essay Goodwill and its Amortization.)

A symbiotic relationship

To overextend an analogy of the business model, CCI is like a professor’s beloved teaching aid in the global “Coca-Cola University”. CCI buys intangible assets (the right to bottle in a territory) at bargain prices from Atlanta (Coca-Cola seems to handsomely reward its top students who make life easier - more on this below). CCI then combines this intangible asset with another intangible asset: its knowledge of how to operate Coca-Cola in difficult, emerging economies (a task aided by swaths of consumer data which it likely derives from its ultimate parent company, Anadolu Grubu, an owner of hundreds of low-cost grocery stores throughout Turkey).

Coca-Cola Atlanta couldn’t be happier with this result. Their prerogative is to employ as little capital as possible while increasing their syrup sales to bottlers. So long as its bottlers are selling more, and more profitable units, Atlanta will, over time, be able to sit back and say “the syrup costs 1% more now.’ If its partners are particularly effective, Atlanta might even be able to periodically say “the syrup costs 2% more now” without materially harming its most effective partners. It is to these particularly effective bottlers that territory rights are likely to flow. And flow they have - to CCI, at some of the best prices anywhere in the Coca-Cola Universe.

Territory acquisitions that demonstrate a vote of confidence in CCI

Coca-Cola’s Bottling Investment Group (BIG) has a particularly odd goal in its business: go extinct, quickly. “We continue to aspire to be the world’s smallest bottler by looking for the right partner, at the right time, with the right value proposition.” In other words, show us why you can grow this territory, and it’s yours. Below summarizes BIG’s recently re-franchised and still yet to be re-franchised territories:

Source: www.investors.coca-colacompany.com

Interestingly, there was one “off the books” territory re-franchised directly to CCI. In a broader process of privatizing its formerly government-owned assets, the Uzbekistan government recently auctioned off its 57% ownership Coca-Cola Uzbekistan, a territory suffering from quintessential government complacency. This bottler had many no-brainer areas of improvement. For instance, its sales of higher-profit products was particularly low compared to neighboring Kazakhstan, a problem easily remedied by leveraging availability bias: simply place products such that they’re easy to buy. To a Coca-Cola bottler, this is the equivalent of adding fertilizer to previously unmanaged soil. The bottler was also only selling Coca-Cola, Sprite, and Fanta - a woefully inadequate product portfolio compared to consumer demand.

The 57% ownership was auctioned off to CCI at an implied value of $430M. Immediately after, Coca-Cola Atlanta sold their 43% share to CCI at an implied value of $210M.

This transaction is interesting for two reasons. First, instead of bringing the underperforming territory into the Bottling Investment Group, Coca-Cola effectively subsidized the sale to go directly to CCI. No remediation period needed. Second, the blended entry price has turned out to be a bargain for CCI, as they immediately rolled out operational improvements and an improved product portfolio. CCI has since grown volume in Uzbekistan at a compounded growth rate of 26%+ with no slowdown in sight.

Pakistan is another such recent transaction that appears to be an effective subsidy to CCI. Coca-Cola’s remaining 50% ownership of the Pakistan bottling company was recently sold to CCI for $300M. To put this sale in perspective, a “market price per unit case” comparison of the neighboring India Pepsi bottler, Varun Beverages, is shown below:

Both India and Pakistan have extremely low per-capita consumption of NARTD beverages, i.e. similarly long runways of growth ahead. They have similar climates (when it comes to selling cold beverages, the hotter the better, and they’re both hot). All variables equal, India may be the preferable territory. But are its prospects for profitable beverage growth over twelve times better than in Pakistan? Maybe. But what might be causing this gap?

Interestingly, CCI helped grow Coca-Cola’s market share in Pakistan’s from 31% in 2013 to over 52% in 2023. After years of CCI’s time and resources going to Pakistan, the low per-unit purchase price may be Coca-Cola saying to CCI “well done, my good and faithful servant” and the valuation, which was prepared by KPMG management consulting, may be a classic instance of a consultant operating under the mantra “whose bread I eat, his song I sing.” Ultimately, time will tell how the acquisition pans out.

Back to the topic of India, let’s turn to one other territory acquisition. CCI has announced that, in addition to now owning 100% of Coca-Cola’s Pakistan operations, they are in discussions with Coca-Cola Atlanta to buy rights to the majority of Bangladesh. A huge acquisition in and of itself, this addition would represent an incremental population and unit case increase to CCI of 20-25%. This would also put CCI’s territory on the adjacent western and eastern borders of India.

Incidentally, India is still held by the Bottling Investment Group, and is therefore up for grabs in the coming years. Also incidentally, the president of the Bottling Investment Group just so happens to be the vice chairman of the board at CCI. Turning to speculation mode here, it’s entirely possible that portions of India may go to CCI in the coming years. At the very least, it’s a geographic match - not to mention the fact that CCI has the strongest balance sheet in the bottling universe, making them a prime candidate for new territory acquisitions. That said, no plans for India have been announced, and the investment thesis by no means requires an India transaction.

Destination Analysis

“Companies such as Coca-Cola might well be labeled ‘The Inevitables’. Forecasters may differ a bit in their predictions of exactly how much soft drink or shaving equipment-business these companies will be doing in ten or twenty years. Nor is our talk of inevitability meant to play down the vital work that these companies must continue to carry out, in such areas as manufacturing, distribution, packaging and product innovation. In the end, however, no sensible observer - not even these companies’ most vigorous competitors, assuming they are assessing the matter honestly - questions that Coke will dominate worldwide for an investment lifetime. Indeed, dominance will probably strengthen.” -Warren Buffett, 1996

Surprisingly, an opportunity to enter at an attractive price to this inevitable growth still exists in 2023. CCI’s territories have particularly low per capita consumption:

Source: CCI Investor Presentation

This is primarily because many consumers do not yet have the income to purchase optional beverage products. As soon as per-capita income reaches a certain threshold, one of the cheapest and most-available luxuries that money can buy is a Coca-Cola product. As incomes rise, so does CCI’s consumer base.

The typical Coca-Cola growth process is to first introduce its three flagship products: Coca-Cola, Sprite, and Fanta. With more spending power, consumer demands grow and change - more tea, more diet products, energy drinks, juices, water, etc. Bottlers can then reach into the arsenal of Coca-Cola’s 200 brands to provide whatever consumers want. This growth process has unfolded in just about every country on every continent on earth, and has been going on for over a century. The attractor pattern is clear - consumers demand more, and more various beverages, and Coca-Cola’s brands dominate. Pepsi tries its best to keep up, but in the end, Coca-Cola tends to win.

Source: The Coca-Cola Company Investor Presentation

Reasonably probable outcomes lead to a 15%+ annual return over 10+ years

A 15% annual return over a 50-year investing lifetime turns ten thousand dollars into ten million. Because of this magical math, investors are like hitchhikers searching for trucks labeled “15% annual return” that are heading toward that investing promised land. When we find a kind trucker that’s definitely headed safely toward the promised land, we’d prefer that the trucker take us 10 miles (years) instead of 2 - otherwise we’ll have to chance finding other truckers (who, of course, might kill us).

For investors seeking the promised land, CCI is a kind, long-haul trucker. A rare “comfortable business at a comfortable price.” Here is a picture of how CCI will get you at least 10 of those coveted 50 years of 15%+ returns:

2034: CCI’s population served has grown from 430 million to 600 million. It reaches this level by acquiring 55% of Bangladesh by 2025. This adds 100 million in population and 300 million unit cases, immediately bumping its population from 430 million to 530 million, and unit cases sold from 1.6 billion to 1.9 billion. From this base, organic population growth of about 1.2% causes 530 million to grow to 600 million in 10 years. Bolstered by new consumers reaching an income level sufficient to start demanding Coca-Cola products, 5% annual volume growth turns 1.9 billion unit cases into 3.1 billion in 10 years.

Product innovations, mix improvement, cost savings, increased purchasing power of consumers, and price increases conspire to boost CCI’s net profit per unit case from 20 cents to 30 cents by 2034 (closer to the 48 cents per unit case earned by “developed market” bottler Coca-Cola Europacific Partners). Net income reaches $930M in 2034.

With $930M in earnings and a 15 year track record of 20% earnings growth under its belt, pessimism fades and CCI trades at a much more rational multiple of 19x earnings, making it worth at least $17.4B. From its current price of $4.3B, this gives investors a 15% annual return.

These time frames might be moot. Neighboring Pepsi bottler Varun Beverages (VBL) has a 5 year compounded net income growth of 47%, and trades at 60x earnings. CCI, armed with better brands, has a 5 year compounded net income growth of 40% and trades at around 10-12x earnings. Meanwhile, zero growth bottlers typically trade at about 15x earnings. Both CCI and Varun operate in similarly low per capita consumption markets, and therefore the growth runway is similar in scope and length. There is no microeconomic ceiling in sight. If investor sentiment reaches anything close to “Indian Pepsi bottler” levels at any time in the next 10 years, CCI would immediately trade at over $17.4B.

Margin of Safety

It’s possible that Coca-Cola, to protect its brand globally, removes its brand from certain territories. This happened recently in Russia. The bottler of Russia, Coca-Cola Hellenic, discloses results of their territories by “developed, developing, and emerging.” The sales volume of their emerging markets territory is almost identical to CCI’s. While it’s impossible to know how the market is weighting these emerging markets territories compared to its other territories, we do know that the emerging markets portion of the business comprises about 60% of volume and 40% of earnings. With a total market value of $10.6B, it’s safe to guess that these “emerging” territories represent at least $4-5B of the $10.6B Coca-Cola Hellenic pie (17% of which is not Coca-Cola branded product). In comparison, CCI is trading at just over $4B while selling 100% Coca-Cola branded products. At these levels, CCI’s second largest market, Pakistan (20% of volume), could become unbranded, and the downside to investors would be close to zero.

Some thoughts:

- it looks like CCI is getting muslim majority country licenses

-> I would guess people drink more NARTD in those countries because there is less beer etc. consumption

-> India is a hindu majority country, they probably won't get the license for the whole country

- climate change probably will increase the consumption of cold NARTDs in the coming decades

They might take a page out of this playbook aswell:

https://x.com/dede_eyesan/status/1677336610126397441?s=20

Have you looked into Anadolu Efes? I saw they own 40% of CCI and have a strong beer business. I was thinking there could be synergies in owning Anadolu Efes over CCI, but I'd love to hear your thoughts